Financial Literacy and Inclusion Education

Financial Literacy Material

Financial Literacy

As part of its efforts to improve public understanding of financial products and services, the Company conducted a financial literacy program involving 250 students and teachers. This initiative also supports the implementation of the POJK No. 3 of 2023 on Enhancing Financial Literacy and Inclusion in the Financial Services Sector for Consumers and the General Public, through the utilization of information and communication technology. Demonstrating its strong commitment to social and environmental responsibility, the Company held the event on October 18, 2024, at SMAN 91, East Jakarta. During the event, the Company donated supporting facilities for the school’s teaching and learning activities. The donation was received directly by the School Principal, Mrs. Widyandari Eka Dhewadjanti, MPd. Through this contribution, the Company hopes to make a positive impact on the community, enhance educational quality, and foster the development of human capital, particularly among the younger generation.

Financial Literacy materials can be accessed via the following link.

Financial Literacy

In carrying out the mandate of the Financial Services Authority through POJK NO 3 of 2023, concerning Increasing Financial Literacy and Inclusion in the Financial Services Sector for Consumers and the Community.

MLI Learning Center, on October 5, 2023, carried out the implementation of the Education, Literacy, and Financial Management Socialization Program with participants from Taman Harapan, Bekasi High School Students with a theme entitled “Getting to Know the Financing Services Business”.

Financial Literacy

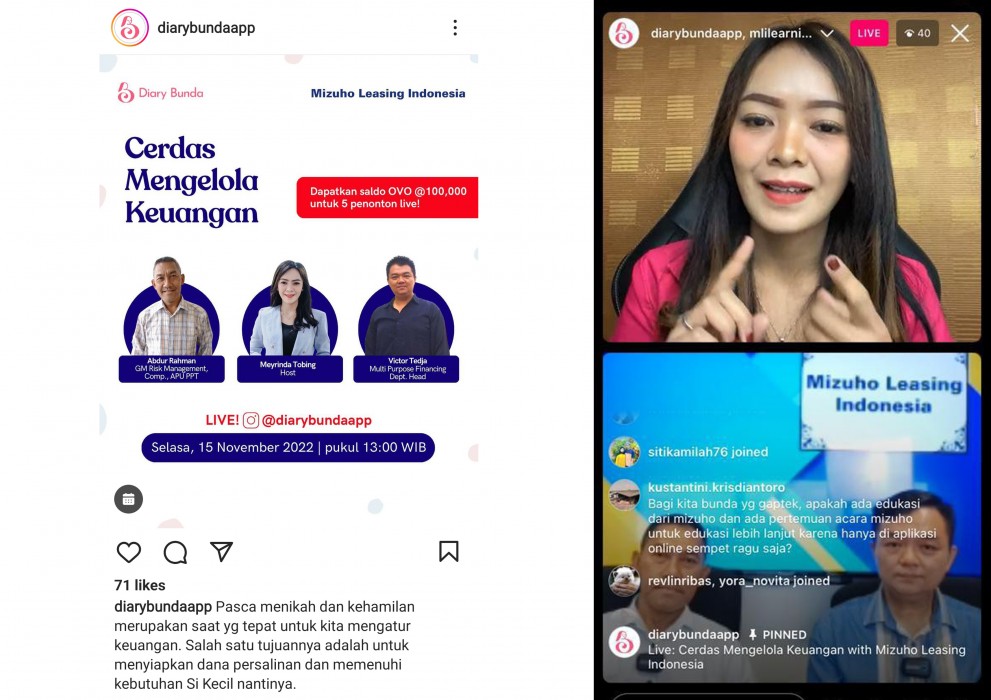

In carrying out the mandate of the Financial Services Authority (“OJK”) through POJK No.76/POJK.07/2016 concerning Increasing Financial Literacy and Inclusion in the Financial Services Sector for Consumers and/or the Public.

The Company carried out Financial Literacy activities in collaboration with Diary Bunda through the Instagram Live platform.

Financial Literacy

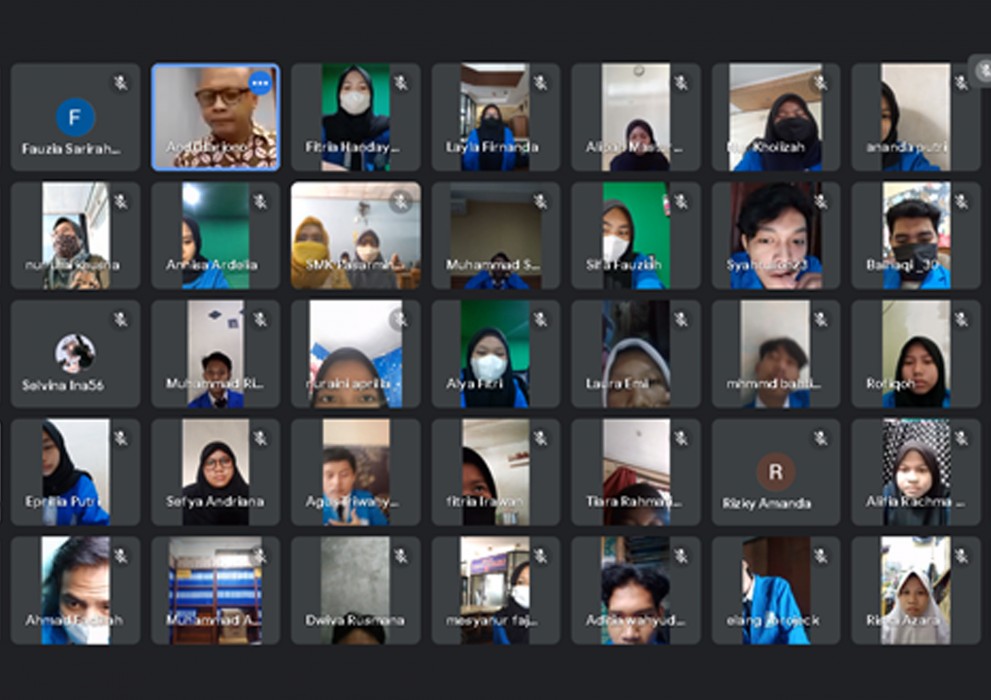

In carrying out the mandate of the Financial Services Authority through POJK No. 6/POJK.07/2016 concerning Improving Financial Literacy and Inclusion in the Financial Services Sector for Consumers and/or the Community, the Company held a Financial Literacy event at SMK Pasarminggu Jakarta. The theme of this literacy activity was “Realizing a Smarter and Inclusive Society in the Digital Finance Era”. In the midst of the COVID-19 pandemic, the Company continued to carry out online Financial Literacy activities in the form of webinars.

The general objective of holding a Webinar on financial inclusion was to improve the community’s economy by reducing economic inequality through increasing and equalizing public access to financial products and services.

The Company believes that a good level of knowledge and understanding of financial products and services would be able to encourage people to use financial products and services in accordance with their needs and abilities in economic activities.

- 1

- 2